- There is no fixed cap on the number or total amount of international yuan transfers made through CIPS via our bank.

Author: Nomundari A

- Yes. For transfers of 1,000,000 CNY or more, customers should notify our bank’s branches, which will in turn inform the relevant regulatory authorities as required.

- If a transaction is flagged under compliance or control review by either our bank or the recipient bank, it may be returned. If that happens, any returned funds will be credited back to your account.

- If the failure is not due to our bank’s fault, the fee will not be refunded.

- Full name, address, and account number (IBAN if applicable) of the recipient;

- Name and SWIFT/CIPS code of the recipient’s bank;

- If available, intermediary bank name and SWIFT/CIPS code;

- Clear description/purpose of payment (e.g., tuition fee, invoice number, goods/services).

- If the recipient bank is not a Direct Participant, the transfer is routed through a Direct Participant bank with which the recipient has a correspondent relationship.

- All types of international yuan transfers are accepted without restrictions, except those constrained by international sanctions or regulatory measures.

- Yes. Depending on the recipient bank’s time zone, the transaction settlement may be delayed and may be received the next business day.

TransBank has implemented Multi-Factor Authentication (MFA) for its internet banking service.

This authentication adds an extra layer of security by requiring users to complete an additional verification step when logging in, rather than relying solely on a password.

Why is MFA (Multi-Factor Authentication) important?

- It helps protect customers’ personal information even if passwords are compromised;

- It prevents cyber fraud and various types of SMiShing attacks;

-

It ensures a high level of security for both individual and organizational data.

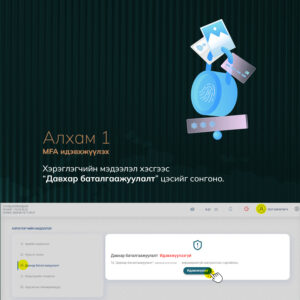

Additionally, for transactions exceeding MNT 5 million for individuals and MNT 20 million for organizations, the OTP verification step can be replaced with MFA (Multi-Factor Authentication).

We provide our customers with instructions on how to perform multi-factor authentication on TransBank’s Internet Banking platform.

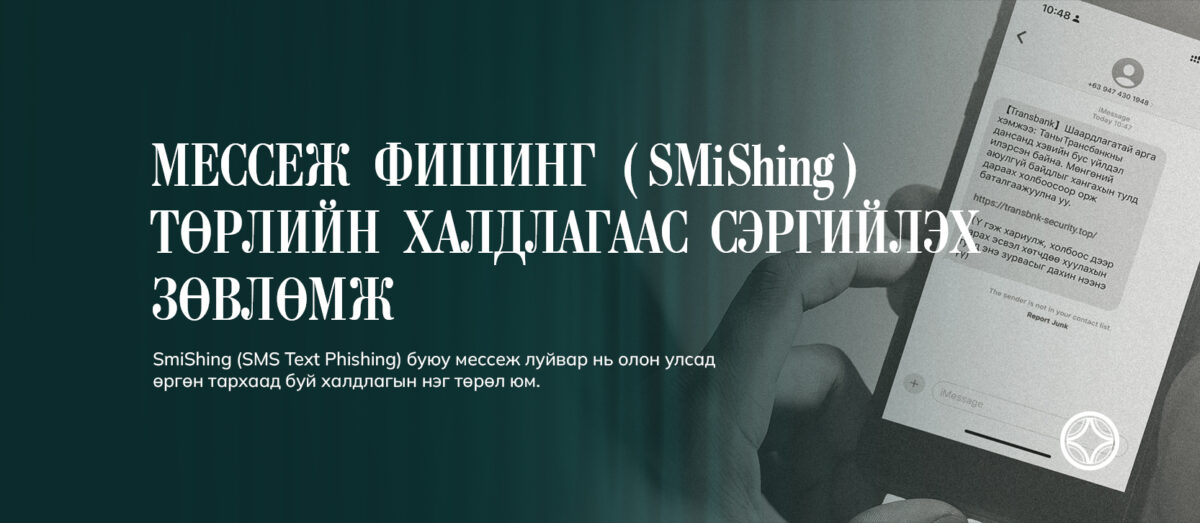

SMiShing (SMS Text Phishing) is a type of fraud that has become widespread internationally. Taking advantage of the widespread use of mobile phones for sending and receiving messages, there has been an increasing trend of deception, cyber fraud, and attacks on personal information. In response, we provide the following warnings and recommendations.

- Be cautious with messages received via phone – Carefully verify links and messages from unknown numbers before opening or responding. Only engage if you are confident about the sender.

- Do not click on suspicious links – Avoid opening links from unknown or doubtful sources as this is an important step to protect your information.

- Be careful when scanning QR codes – Even if the source seems trustworthy, always verify and confirm the destination address before proceeding.

- Keep your device and applications updated regularly – Updates improve security and help prevent attacks.

The bank will never request you to provide confidential information such as your internet banking username or password. If you receive such a request, it is crucial to verify the authenticity of the sender’s official email address and phone number to protect yourself from potential risks.

Cybersecurity starts with your responsibility.