Тээвэр хөгжлийн банк “Moody’s” агентлагийн B3 “Тогтвортой” үнэлгээг 4 жил дараалан хангалаа.

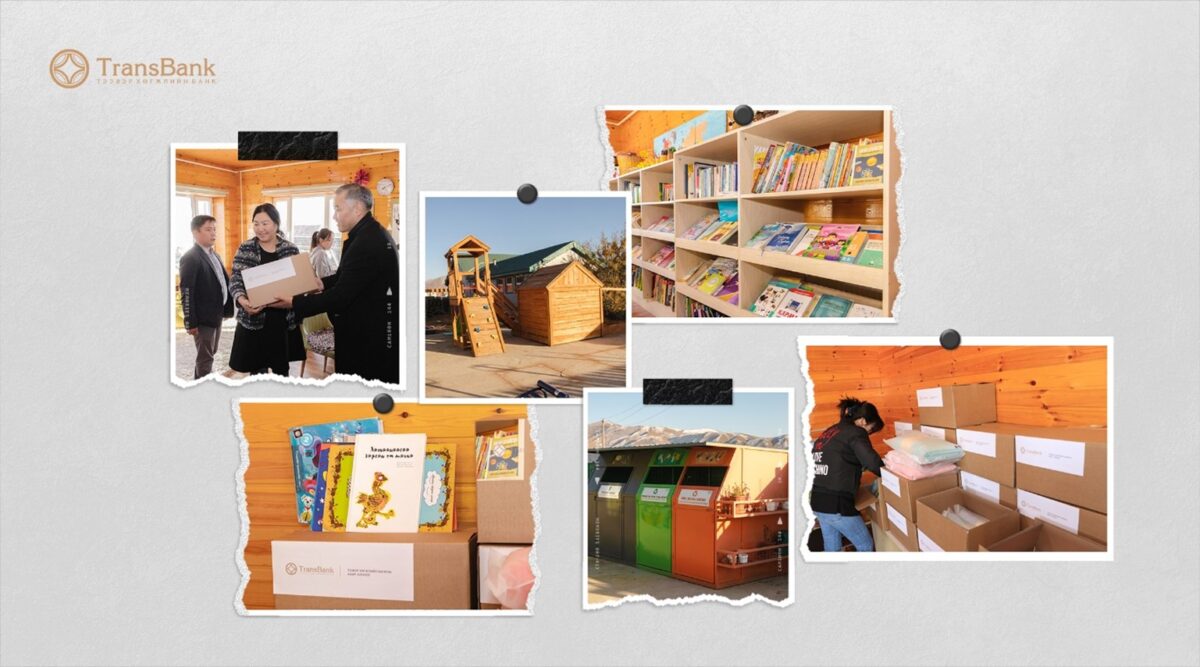

Тээвэр хөгжлийн банк нь нийгмийн хариуцлагын хүрээнд нийгмийн сайн сайхан, эрүүл мэнд, хүүхэд залуучуудын мэдлэг боловсрол, байгаль орчинг хамгаалах, хүний эрх, ажилтнуудын хөгжлийн чиглэлүүдэд голчлон анхаарч үйл ажиллгаануудыг зохион байгуулан ажилладаг билээ.

Энэ хүрээнд ирээдүй болсон хүүхэд багачуудад дэмжлэг үзүүлэх зорилгоор Тээвэр хөгжлийн банкны ажилтнууд санаачлага гарган “Цөлийн сарнай” асрамжийн төвд буй охидод тав тухтай орчинд амьдрахад нь туслахаар “Өнгө нэмье” уриатай хандивын аяныг өнгөрсөн аравдугаар сард нийт ажилтнуудынхаа дунд зохион байгууллаа.

Банкны хамт олноос санаачлан өрнүүлсэн энэхүү аянд 200 гаруй ажилтнууд оролцон асрамжийн төвд нэн шаардлагатай эрүүл ахуйн эд зүйлс болон тэдний мэдлэгт хувь нэмэр оруулах 1000 гаруй номыг бэлэг болгон хүргэлээ.

Ажилтнуудын сайн дурын санаачлагаар хэрэгжсэн уг төсөл нь асрамжийн төвийн хүүхэд багачууд, багш нарын талархлыг хүлээсэн үйл ажиллагаа боллоо.

Нийгмийн хариуцлагын хүрээнд ажилтнууд санаачлан “Цөлийн сарнай” асрамжийн төвд хэрэгцээт зүйлс, 1000 гаруй ном бэлэглэлээ.

Тээвэр хөгжлийн банк Сингапур болон Европ дахь нэр хүндтэй хувийн банкуудтай хамтын ажиллагааг амжилттай эхлүүллээ.

| BANK | CURRENCY | ACCOUNT NUMBER | SWIFT CODE | LOCATION | |

|

OVERSEA-CHINESE BANKING CORPORATION /OCBC/ | USD | 503-558751-301 | OCBCSGSG | SINGAPORE |

| SGD | 717-370571-001 | ||||

| HKD | 503-295065-201 | ||||

|

DBS BANK | SGD | 037-003681-0 | DBSSSGSG | SINGAPORE |

|

SUMITOMO MITSUI BANKING CORPORATION | JPY | 5402 | SMBCJPJT | TOKYO, JAPAN |

|

KEB HANA BANK | USD | 0963THR003000018 | KOEXKRSE | SEOUL, KOREA |

|

COMMERZBANK AG | EUR | 400878504000EUR | COBADEFF | FRANKFURT, GERMANY |

| GBP | 400878504000GBP | ||||

|

BAYERISCHE LANDESBANK | EUR | 6370716 | BYLADEMM | MUNICH, GERMANY |

|

PT BANK NEGARA INDONESIA | USD | 766022285 | BNINIDJA | JAKARTA, INDONESIA |

|

BANK OF CHINA | USD | 150889705214 | BKCHCNBJ880 | HOHHOT, CHINA |

| CNY | 155689709276 | ||||

|

CHINA CONSTRUCTION BANK | CNY | 15001658408052502829 | PCBCCNBJNME | ERLIAN, CHINA |

|

AGRICULTURAL BANK OF CHINA | CNY | 05999901040000327 | ABOCCNBJ050 | HOHHOT, CHINA |

|

BANK OF INNER MONGOLIA | USD | 115914236010000466 | HSSYCNBH010 | ERLIAN, CHINA |

| CNY | 115901236010000573 | ||||

|

ZHEJIANG CHOUZHOU COMMERCIAL BANK | USD | 15601142320800002742 | CZCBCN2X | HANGZHOU, CHINA |

| EUR | 15601382320800001875 | ||||

| CNY | 15601012320890002740 | ||||

|

AKBANK | TRY | TR300004600999888000000090 | AKBKTRIS | ISTANBUL, TURKEY |

|

INTERNATIONAL BANK FOR ECONOMIC COOPERATION | EUR | 30111978300000001734 | IBECRUMM | MOSCOW, RUSSIA |

| USD | 30111840700000001734 | ||||

| RUB | 30111810400000001734 | ||||

| CNY | 30111156100051001734 |

- ААНБ-ын “ХЭЗ-ийн бүртгэлээс хасалт хийлгэх тухай” Маягт-4-ийг бөглөсөн албан бичиг

- Үйлчилгээний хураамж төлсөн төлбөрийн баримт (12000 төгрөг/1хүн, Төрийн сан, ХХҮЕГазар 100900017002 данс)

- ААНБ-ын улсын бүртгэлийн гэрчилгээний хуулбар

- А4 хэмжээстэй цаасны нүүрэн дээр гадаадын иргэний паспорт болон “HG” ангиллын визийн дардастай хуудасны хамт хуулбарлаж, ард талд нь ХХҮЕГ-аас олгосон “Монгол Улсад хөдөлмөр эрхлэх зөвшөөрлийн үнэмлэх” эх хувиар хураалгаж, мөн ГИХГ-аас олгосон “Монгол Улсад оршин суух үнэмлэх”-ний сунгалттай хуулбарыг тус тус зайлшгүй хавсаргасан байна

- Шаардлагатай бол бусад материал

- ААНБ-ын Гадаадын ажиллах хүч, мэргэжилтнийг үргэлжлүүлэн ажиллуулах зайлшгүй хэрэгцээ шаардлагыг дэлгэрэнгүй тайлбарласан Маягт-3-ын дагуу бөглөсөн албан бичиг

- Үйлчилгээний хураамж төлсөн төлбөрийн баримт (22 500 төгрөг/1хүн, Төрийн сан, ХХҮЕГазар 100900017002 данс)

- Сунгагдан ажиллах хугацаагаар ажлын байрны төлбөр тушаасан баримт (640 000 төгрөг/1хүн/1сар, Төрийн сан, ХЭДС 100900037010 данс), Жич: Мэргэжилтэнд материалаа шалгуулсны дараа зохих төлбөрийг тушаана. (2020 оны 1 дүгээр сарын 1-ээс Ажлын байрны төлбөр 840000 төгрөг/1хүн/1сар, болж өөрчлөгдөнө)

- “Монгол Улсад хөдөлмөр эрхлэх зөвшөөрлийн үнэмлэх” дээр сунгалт хийлгэнэ. (3000 төгрөг/1 хүн, Төрийн сан, ХХҮЕГазар 100900017002 данс). Хэрэв сунгалт хэсэг дууссан бол үнэмлэх дахин авна. ХЭЗ-ийн үнэмлэхний 1 хувь цээж зураг (Тавигдах шаардлага: хэмжээ 3×4 см; цэнхэр дэвсгэртэй, сүүлийн 6 сарын дотор авахуулсан байх, тод байх)

- ААНБ-ын улсын бүртгэлийн гэрчилгээний хуулбар

- Тусгай зөвшөөрлийн гэрчилгээ, түүний хавсралтын хуулбар

- Оршин суух үнэмлэхний хуулбар

- Засгийн газрын тогтоолоор квотоос чөлөөлөгдсөн бол ЗГТ-ын хуулбар

- Тухайн байгууллагад нийгмийн даатгалын шимтгэл төлдөг хэдэн ажилтантайг баталгаажуулсан нийгмийн даатгалын сүүлийн сарын НД-7 болон НД-8 маягт (Тавигдах шаардлага: ажиллуулж буй гадаадын ажиллах хүч, мэргэжилтэнд НДШ төлөлт хийгдсэн байх)

- Гадаадын хуулийн этгээдтэй хөдөлмөр эрхлүүлэх талаар байгуулсан Хөдөлмөрийн гэрээ, түүний монгол хэл дээрх орчуулгын хамт (Тавигдах шаардлага: Хөдөлмөрийн гэрээ сунгагдсан байх, орчуулгын товчоогоор баталгаажсан тэмдэгтэй)

- Гадаадын иргэний паспортын хуулбар (“HG” ангиллын визийн дардастай хуудасны хамт)

- Хэрэв ГАХМ-ний Монгол Улсад хөдөлмөр эрхэлсэн хугацаа нь 6 сараас дээш бол ХДХВ (HIV)-ын шинжилгээг давтан, 1 жилээс дээш бол 5 төрлийн үзлэг шинжилгээг давтан тус тус өгсөн Эрүүл мэндийн болон Хөдөлмөрийн сайдын хамтарсан тушаалаар батлагдсан маягтын дагуу эрүүл мэндийн үзлэг, шинжилгээнд хамруулсан дүгнэлт бичиг.

Маягт татах холбоос – Сунгалт (hudulmur-halamj.gov.mn)

- Хөдөлмөр эрхлүүлэх эдийн засгийн салбарын Яам, агентлагийн тодорхойлолт /Жич: Зөвхөн Боловсролын салбарт хамаарна/

Бүрдүүлэх материал

- ААНБ-ын гадаадаас “HG” ангиллын визээр урьж ирүүлсэн ажиллах хүч, мэргэжилтнээ Монгол Улсын хилээр орж ирснээс хойш ажлын 10 хоногт багтааж “Хөдөлмөр эрхлэх зөвшөөрөл хүсэх” Маягт-2-ыг дэлгэрэнгүй бөглөсөн албан бичиг

- Үйлчилгээний хураамж төлсөн төлбөрийн баримт (22500 төгрөг/1 хүн, Төрийн сан, ХХҮЕГазар 100900017002 данс)

- Ажлын байрны төлбөр тушаасан баримт (640000 төгрөг/1хүн/1сар, Төрийн сан, ХЭДС 100900037010 данс), Жич: Мэргэжилтэнд материалаа шалгуулсны дараа зохих төлбөрийг тушаана. (2020 оны 1 дүгээр сарын 1-ээс Ажлын байрны төлбөр 840000 төгрөг/1хүн/1сар, болж өөрчлөгдөнө)

- “Монгол Улсад хөдөлмөр эрхлэх зөвшөөрлийн үнэмлэх”-ний үнэ тушаасан баримт (3000 төгрөг/1 хүн, Төрийн сан, ХХҮЕГазар 100900017002 данс), ХЭЗ-ийн үнэмлэхний 1 хувь цээж зураг (тавигдах шаардлага: хэмжээ 3×4 см, цэнхэр дэвсгэртэй, сүүлийн 6 сарын дотор авахуулсан байх, тод байх)

- ААНБ-ын улсын бүртгэлийн гэрчилгээний хуулбар

- Тусгай зөвшөөрлийн гэрчилгээ, түүний хавсралтын хуулбар

- Засгийн газрын тогтоолоор квотоос чөлөөлөгдсөн бол ЗГТ-ын хуулбар

- Гадаадын иргэний паспортын хуулбар болон “HG” ангиллын виз дээр хилээр орж ирсэн штамп дарагдсан хуудасны хамт

- Эрүүл мэндийн болон Хөдөлмөрийн сайдын хамтарсан тушаалаар батлагдсан маягтын дагуу эрүүл мэндийн үзлэг, шинжилгээнд хамруулсан дүгнэлт бичиг (Тавигдах шаардлага: хөдөлмөр эрхлүүлэх газрын харьяалах эрүүл мэндийн төвд гадаадын ажиллах хүч, мэргэжилтнүүдийг авч очин ЭМҮШ-нд хамруулж, эмч, ерөнхий эмчийн гарын үсэг тайлал, огноо, дүгнэлтийг гаргацтай бичүүлж, тэмдэг дарж баталгаажуулсан байна) –

Маягт татах холбоос: Зөвшөөрөл (hudulmur-halamj.gov.mn)

- Маягт-1 –ийг бүрэн бөглөсөн тухайн ААНБ-ын албан тоот

- Үйлчилгээний хураамж төлсөн төлбөрийн баримт (25000 төгрөг/1 хүн, Төрийн сан, ХХҮЕГазар 100900017002 данс)

- ААНБ-ын улсын бүртгэлийн гэрчилгээний хуулбар

- Тусгай зөвшөөрлийн гэрчилгээ, түүний хавсралтын хуулбар

- Засгийн газрын тогтоолоор квотоос чөлөөлөгдсөн бол ЗГТ-ын хуулбар

- Тухайн байгууллагад нийгмийн даатгалын шимтгэл төлдөг хэдэн ажилтантайг баталгаажуулсан нийгмийн даатгалын сүүлийн сарын НД-7 болон НД-8 маягт

- Хөдөлмөр эрхлүүлэх эдийн засгийн салбарын Яам, агентлагийн тодорхойлолт

- Тухайн байгууллагын харьяалагдах аймаг, дүүргийн Хөдөлмөр, халамжийн үйлчилгээний газар, хэлтсийн санал

- Гадаадын хуулийн этгээдтэй хөдөлмөр эрхлүүлэх талаар байгуулсан Хөдөлмөрийн гэрээ, түүний монгол хэл дээрх орчуулгын хамт (орчуулгын товчоогоор баталгаажсан тэмдэгтэй)

- Гадаадын иргэний паспортын хуулбар

- Гадаадын иргэний хөдөлмөр эрхлүүлэх салбарт их, дээд сургууль төгссөнийг илтгэн харуулах мэргэжлийн үнэмлэх, дипломын хуулбар (орчуулгын товчоогоор баталгаажсан тэмдэгтэй)

- Дараах материалуудыг авч ирэх:

Маягт-1

ҮАМАТ-08

Маягт-5

Маягт-5

Маягт-6

Маягт-7

Маягт татах холбоос: Урилга (hudulmur-halamj.gov.mn)

| Хөрөнгө оруулалтын гэрээ | 500 тэрбум төгрөгөөс дээш хөрөнгө оруулалттай

|

| Тогтворжуулах гэрчилгээ | НӨАТ, ААНОАТ, Гаалийн албан татвар, Нөөц ашигласны төлбөр

|

| Эдийн засгийн чөлөөт бүсүүд | Эхний 5 жил татвараас чөлөөлнө

|

| Жижиг дунд үйлдвэр | Гаалийн албан татвар, НӨАТ-аас чөлөөлнө

|

Доор дурдсан тохиолдолд импортолсон техник, тоног төхөөрөмжийг барилга угсралтын ажлын хугацаанд гаалийн албан татвараас чөлөөлж, нэмэгдсэн өртгийн албан татварыг “0” хүртэлх хувь, хэмжээгээр ногдуулж болно:

- Барилгын материал, газрын тос, хөдөө аж ахуйн боловсруулах болон экспортын бүтээгдэхүүний үйлдвэр барих;

- Нано, био болон инновацийн технологи агуулсан бүтээгдэхүүний үйлдвэр барих;

- Эрчим хүчний үйлдвэр болон төмөр зам барих.