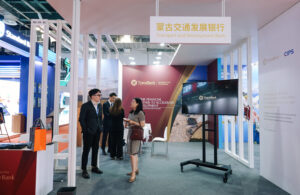

TransBank has met the criteria to become a Direct Participant member bank of China’s Cross-border Interbank Payment System (CIPS), successfully implementing the yuan clearing and payment transmission system not only in Mongolia but also in Northeast Asia for the first time.

This advanced international cross-border payment and fund transfer system, operated by the Bank of China, offers a technological infrastructure designed to execute yuan transactions with the key advantages of being “fast, convenient, and cost-efficient” tailored to meet the needs and preferences of customers.

Currently, there are approximately 170 banks worldwide that hold accounts within the CIPS system, enabling them to send and receive transactions directly as direct participants. Additionally, about 1,500 indirect participants access the system through these direct participants.

By joining the CIPS system as a direct participant, TransBank aims to deliver internationally standardized private banking services to its clients, while gaining the following key advantages.

- Offering customers—both corporate and individual—a simpler, faster (real-time), more cost-effective, reliable, and secure international payment solution;

- Supporting trade and investment flows between Mongolia, China, and other countries in Northeast Asia;

- Diversifying the financing channels for the national economy;

- Contributing to the stability of the Mongolian Tugrug exchange rate, in line with the policies of the Bank of Mongolia.

This milestone marks TransBank not only as the first bank in Mongolia to join the global CIPS yuan payment network, but also as a reflection of the trust and responsibility placed in the bank by its entire customer base.