Тээвэр хөгжлийн банк нь нийгмийн хариуцлагын хүрээнд нийгмийн сайн сайхан, эрүүл мэнд, хүүхэд залуучуудын мэдлэг боловсрол, байгаль орчинг хамгаалах, хүний эрх, ажилтнуудын хөгжлийн чиглэлүүдэд голчлон анхаарч үйл ажиллгаануудыг зохион байгуулан ажилладаг билээ.

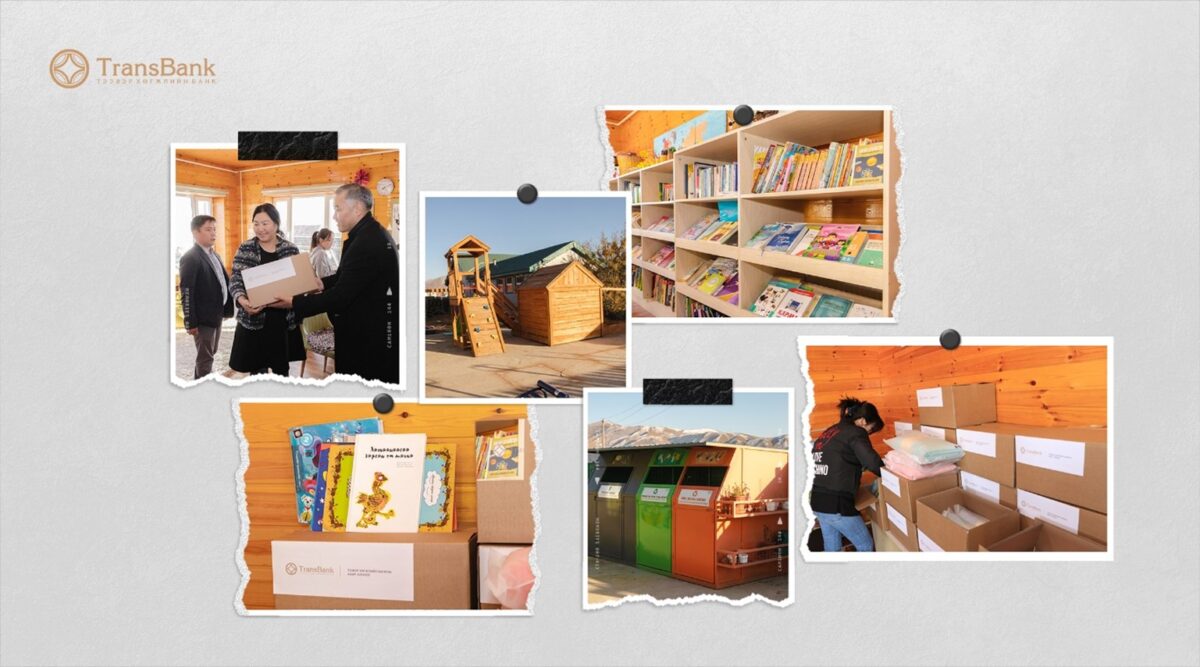

Энэ хүрээнд ирээдүй болсон хүүхэд багачуудад дэмжлэг үзүүлэх зорилгоор Тээвэр хөгжлийн банкны ажилтнууд санаачлага гарган “Цөлийн сарнай” асрамжийн төвд буй охидод тав тухтай орчинд амьдрахад нь туслахаар “Өнгө нэмье” уриатай хандивын аяныг өнгөрсөн аравдугаар сард нийт ажилтнуудынхаа дунд зохион байгууллаа.

Банкны хамт олноос санаачлан өрнүүлсэн энэхүү аянд 200 гаруй ажилтнууд оролцон асрамжийн төвд нэн шаардлагатай эрүүл ахуйн эд зүйлс болон тэдний мэдлэгт хувь нэмэр оруулах 1000 гаруй номыг бэлэг болгон хүргэлээ.

Ажилтнуудын сайн дурын санаачлагаар хэрэгжсэн уг төсөл нь асрамжийн төвийн хүүхэд багачууд, багш нарын талархлыг хүлээсэн үйл ажиллагаа боллоо.